How to Invest in Air Rights?

When people think of real estate investments, their minds often jump to land, buildings, or properties. Yet, one less obvious, highly lucrative opportunity lies in a realm that most overlook entirely — the air above us. This is where air rights come into play.

What Are Air Rights?

Air rights refer to the legal ability to control, use, or sell the space above a piece of land or building. Although traditionally linked to skyscrapers or high-rise developments, air rights have recently become a flexible investment tool for innovative entrepreneurs and savvy investors. Owners can sell or lease these rights to developers, who can, in turn, use the space to construct higher or larger buildings. For example, in major urban areas like New York City or Chicago, where every inch of buildable space matters, air rights have transformed skylines and created opportunities that go beyond ground-level real estate. If you're looking for passive income, long-term profit, or a way to diversify your portfolio, investing in air rights could be worth exploring.

How Do Air Rights Work?

To fully understand how air rights investments operate, consider these key concepts:

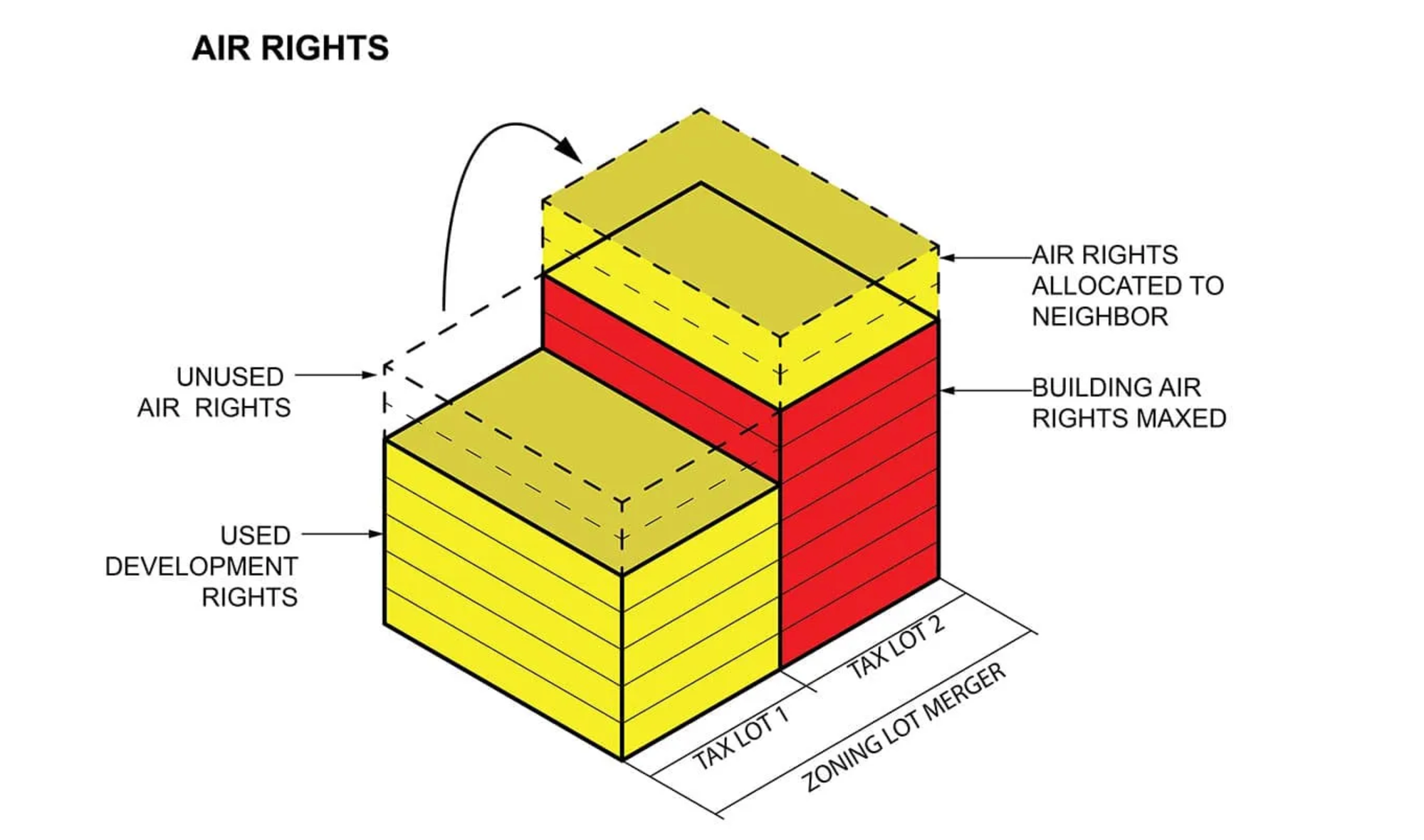

1. Zoning Laws and Floor-Area Ratios (FAR): Each property is

assigned a maximum allowable height or size based on zoning laws. A plot with

unused air rights can transfer or sell the difference to another property owner

seeking to exceed their own height restrictions.

2. Transferable Development Rights (TDRs): These allow air rights

to be transferred between properties, generally on the condition that the two

sites are nearby and share a zoning code.

3. Air Easements: These are agreements that grant developers or

parties the right to the airspace above an adjacent or nearby property without

technically owning the property itself.

These mechanisms vary by jurisdiction, so always consult local laws and ordinances before pursuing an air rights investment.

Benefits of Investing in Air Rights

Why consider air rights instead of traditional real estate investments? Here are a few compelling reasons:

1. Maximize Returns in Urban Markets

Land scarcity in cities like New York, Hong Kong, or Tokyo causes land prices to

skyrocket. Air rights offer a workaround, allowing developers to effectively expand upward without buying additional plots of land.

2. Diversify Your Portfolio

Adding air rights to your investment portfolio can diversify your assets, especially

in the lucrative real estate sector. Unlike physical property, air rights aren’t prone to wear and tear, reducing maintenance costs over time.

3. Creative Development Opportunities

Air rights open the door to innovative projects, such as building sky bridges,

rooftop gardens, or multi-level developments. For instance, luxury buildings

often feature penthouses or observation decks that command premium prices.

4. Sustainability Potential

Vertical development can reduce urban sprawl and promote sustainable land use practices. Forward-thinking investors appear more attractive to environmentally-conscious developers and public officials.

Steps to Invest in Air Rights

Investing in air rights may seem daunting, but breaking it down into a few strategic steps can simplify the process. Start by researching local zoning laws to understand the regulations in your target area, as policies around air rights vary widely. Then, identify properties with untapped air rights, often underdeveloped buildings in high-demand locations like single-story structures in urban hubs. Collaborate with experts like developers or architects to assess the potential value and bring in professionals to conduct detailed valuations, considering factors such as location, zoning restrictions, and future development prospects.

Once you're ready to act, ensure all negotiations and agreements are legally sound by involving qualified legal counsel. Whether buying, selling, or leasing air rights, the contracts must adhere to local property laws to avoid complications. Finally, stay ahead of market trends by tracking urban development, changes in zoning laws, and economic shifts. This proactive approach positions you to predict value spikes and maximize returns on your air rights investments.

Real-Life Example of Air Rights Success

One of the most notable success stories in air rights investments comes from Manhattan, New York. Look no further than the Hudson Yards development project. Leveraging air rights above a working rail yard, developers created a $25 billion mega project featuring high-end retail, residential buildings, and even cultural spaces.

Potential Risks in Air Rights Investments

While the rewards of air rights investments are appealing, it’s crucial to assess potential risks:

· Regulatory Barriers: Some markets impose restrictions or procedural obstacles on trading air rights, complicating their acquisition.

· Economic Volatility: Much like traditional real estate, air rights are subject to demand fluctuations influenced by broader economic conditions.

· Legal Complications: Drafting contracts related to air rights can be legally complex, making it vital to hire seasoned attorneys.

Should You Invest in Air Rights?

If you're an experienced investor looking for unique opportunities, or you're well-versed in real estate laws, air rights can be a lucrative asset. However, if you’re new to the concept, start small. Educate yourself, partner with knowledgeable professionals, and conduct due diligence before stepping into this niche market.

Air rights embody the notion that value exists in every square foot—even the ones

we don’t immediately see. With urbanization continuing at a rapid pace, this

innovative investment avenue offers untapped potential to forward-thinking real

estate professionals and investors alike.

Want to learn more about niche investments like air rights? Stay updated on real

estate trends, legal changes, and success stories by subscribing to our

newsletter!

Air Rights In Manhattan, NY

Happy Hunting!😃

Disclaimer

Cashflow Hub is a Bluelofts's newsletter that breakdown real estate and middle market opportunities with cash flow potential that hit the market. Subscribe for free and become a savvier investor. Cashflowhub or its affiliates present this post solely for informational purposes. The information provided herein is not verified or confirmed by Cashflowhub. Moreover, Cashflowhub does not make any offers to readers to participate in any transaction or opportunity described in this post. This post is not intended to recommend any investment and should not be considered as an offer to sell or a solicitation of an offer to purchase an interest in any current or future investment vehicle managed or sponsored by Bluelofts Inc or its affiliates (collectively referred to as "Bluelofts"; each investment vehicle referred to as a "Fund"). Any solicitation to purchase an interest will only be made through a definitive private placement memorandum or other offering document.