16 Multifamily Units at $5,750,000 in Tyler Tx!💰

Opportunities for acquire 16 units multifamily in Tyler Tx:

- Location: Tyler Tx

- Asking Price: $5,750,000

- Highest and Best Use: Apartments for rent

- Listing URL: https://www.loopnet.com/Listing/8406-Cambridge-Rd-Tyler-TX/29200367/

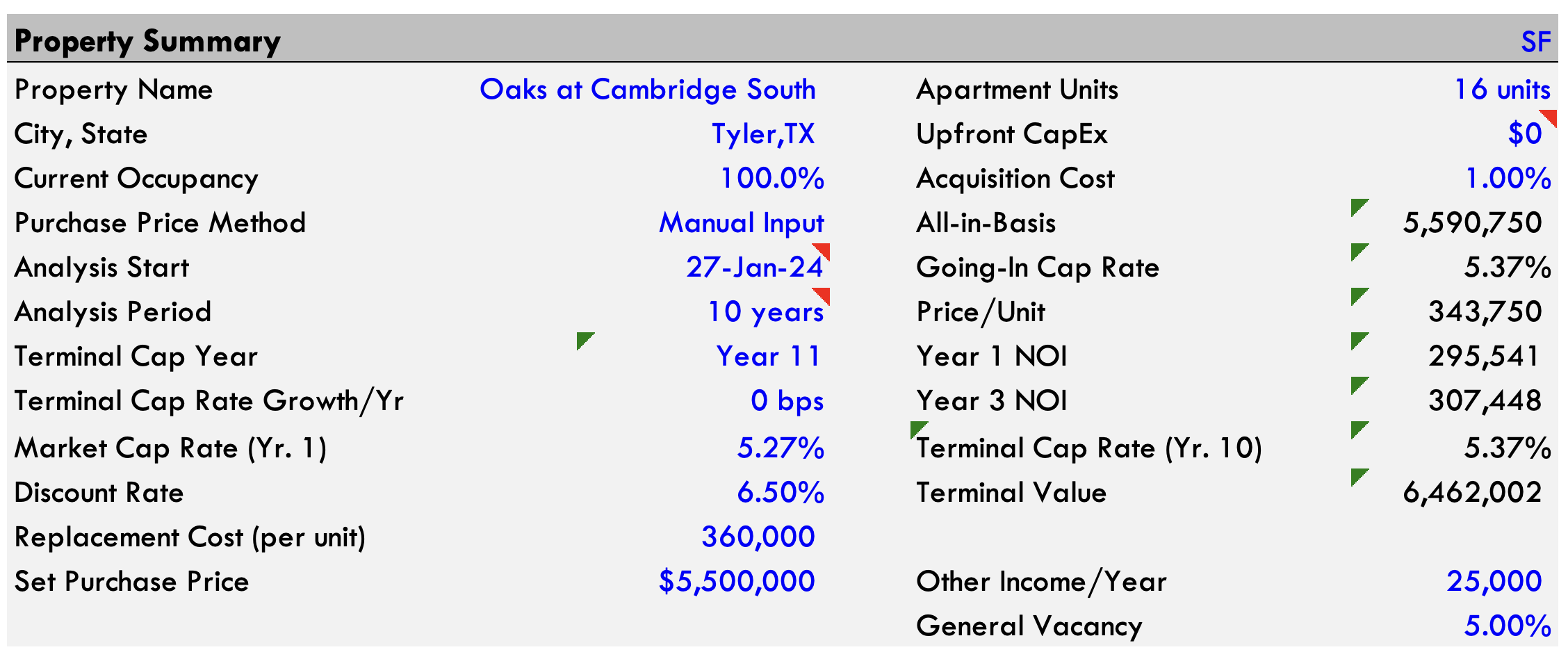

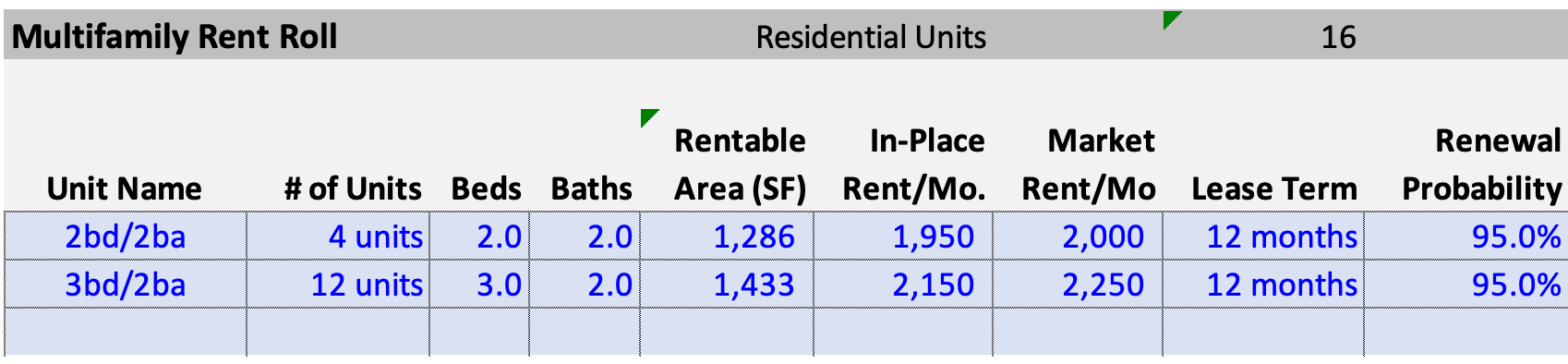

Model Assumptions

The first section of this underwriting model will be the assumptions area and inputs. Notice we have included all historical inputs and key operating, financing, and transaction assumptions here:

Key Points

· Manual Input = Purchase price manually set

· Cap Year 1 NOI = Year 1 NOI capitalized at 'Market Cap Rate" (Year 1 NOI ÷ Market Cap Rate)

· Analysis start = The date you anticipate closing on the property

· Analysis period = Duration you intend to hold the property

· Terminal cap year = Determines which year's NOI to be used for calculating exit value (typically either same as analysis period or one year after analysis period)

· Terminal Cap Rate Growth /Yr. = Used to determine exit cap rate; exit cap rate is calculated as the going-in cap rate plus the exit cap rate growth per year through to the end of the analysis period (e.g. if going-in cap rate is 6.00% and the exit cap rate growth per year is 5 basis points, then the exit cap rate in year 10 would be 6.50%)

· Market Cap Rate Yr. 1 = The market cap rate for this type of property in year one; use market reports, professional knowledge, broker guidance to set this value

· Discount rate = The discount rate is used to calculate the DCF value; often the discount rate is the unlevered rate of return the acquirer wishes to obtain on the investment

· Replacement Cost (per unit) = The cost to develop/build this type of property today on a per unit basis

· Terminal value = the price at which the property is expected to sell at the end of the hold period

· Acquisition Cost = Cost of acquisition (due diligence, closing costs, etc) as a % of purchase price; does NOT included lender fees

What data will you need?

A number of key assumptions drive your model. The more information gathered around these key inputs, the more useful your model becomes. Worth conducting diligence on a few key assumptions:

Purchase Price

Sale Price

Effective Rents

This information can be found in various places, such as:

Broker quotes (Purchase Price)

Sales Comparable (Purchase Price, Sale Price)

Market Surveys (Effective Rents)

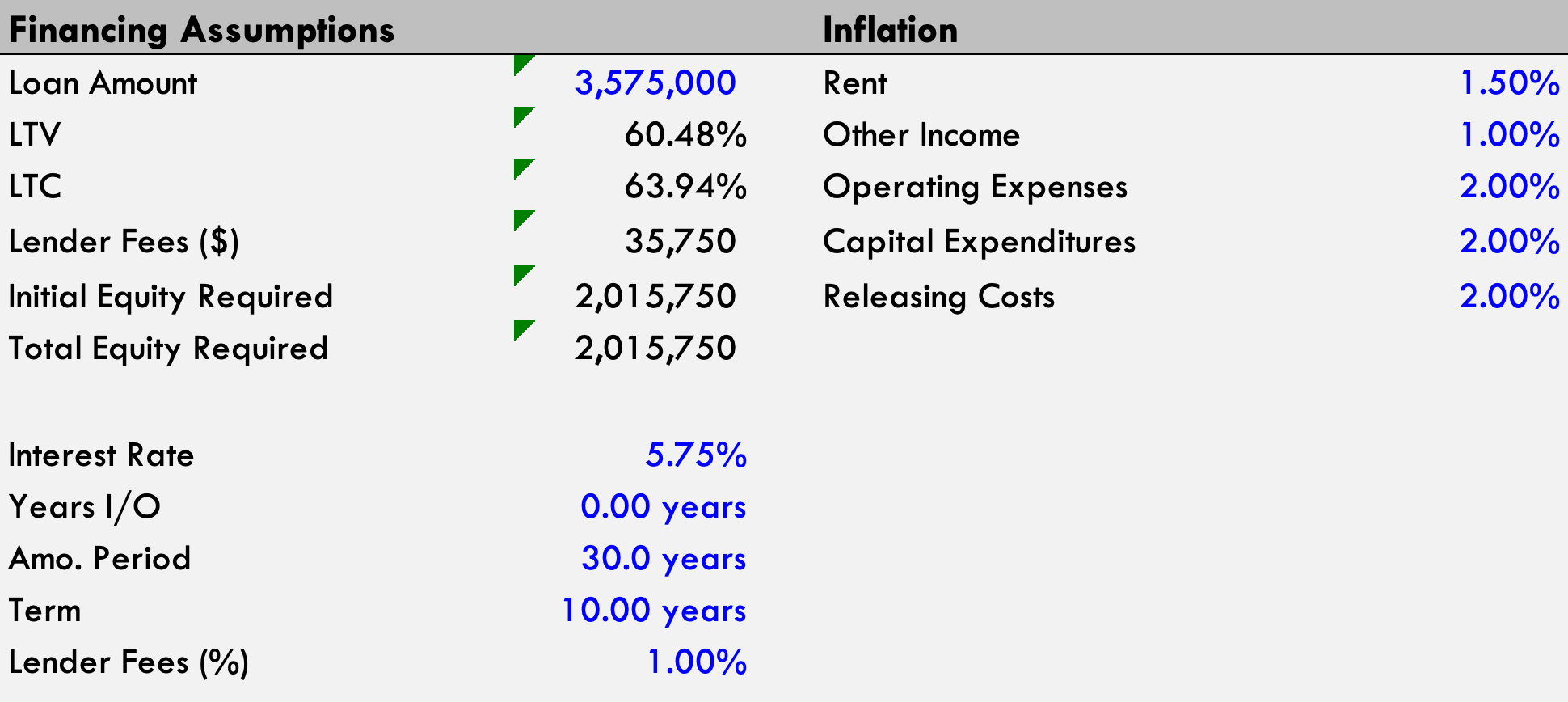

Financing Assumptions:

In the next section, we will forecast debt payments to arrive at levered returns – which is actually what the returns will be, since real estate deals are usually funded with some debt.

In this example, we have shared a simple capital structure including a senior loan of $3,575,000, resulting in a loan-to-value (LTV) ratio of 65% - a commonly used leverage point for multifamily real estate transactions.

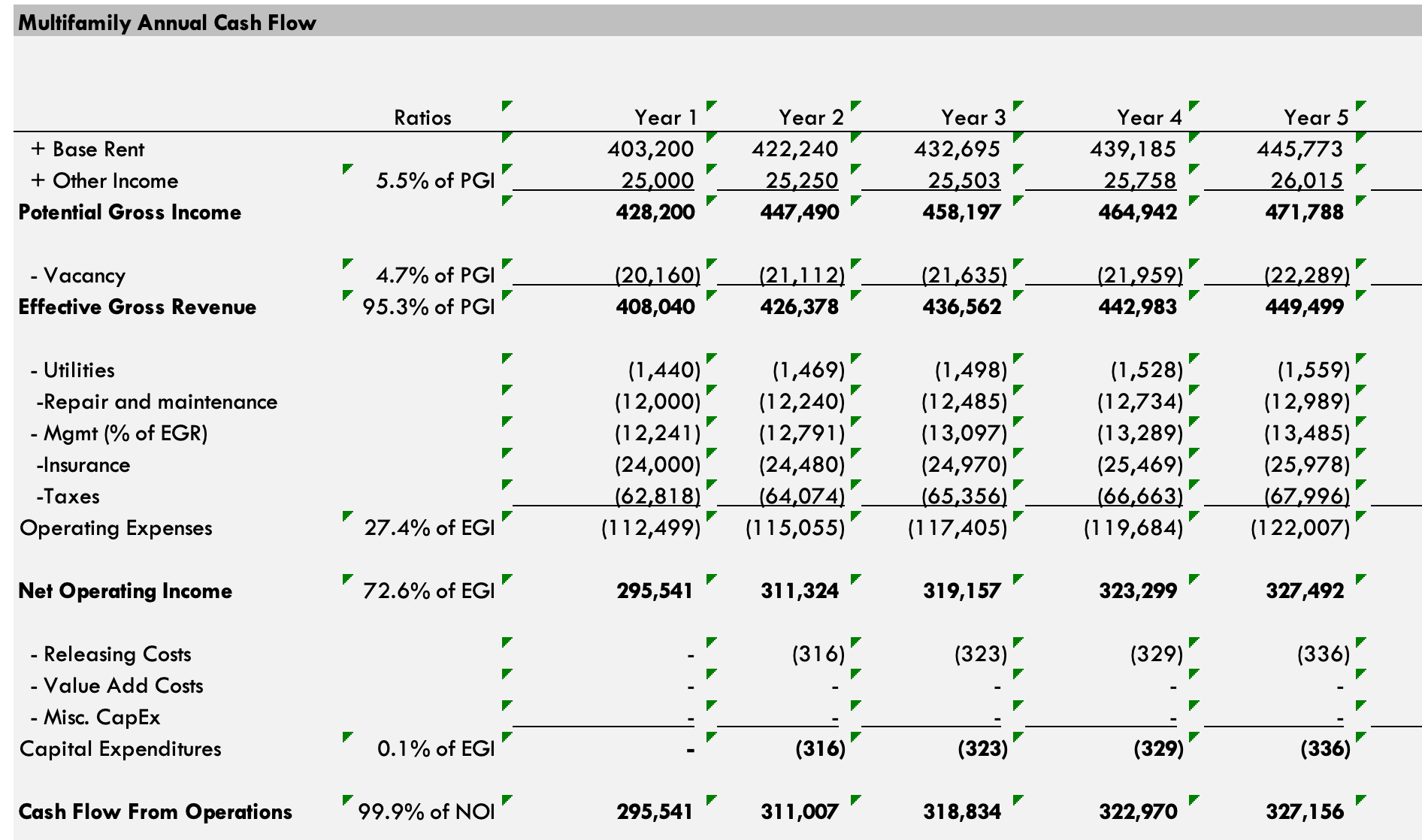

Annual Cash flow:

In the next section, we will forecast the annual cash flow to arrive at levered returns – the amount of income that a property produces after all operating expenses have been paid. While helpful to provide an indication of a property's potential profitability.

Transaction summary:

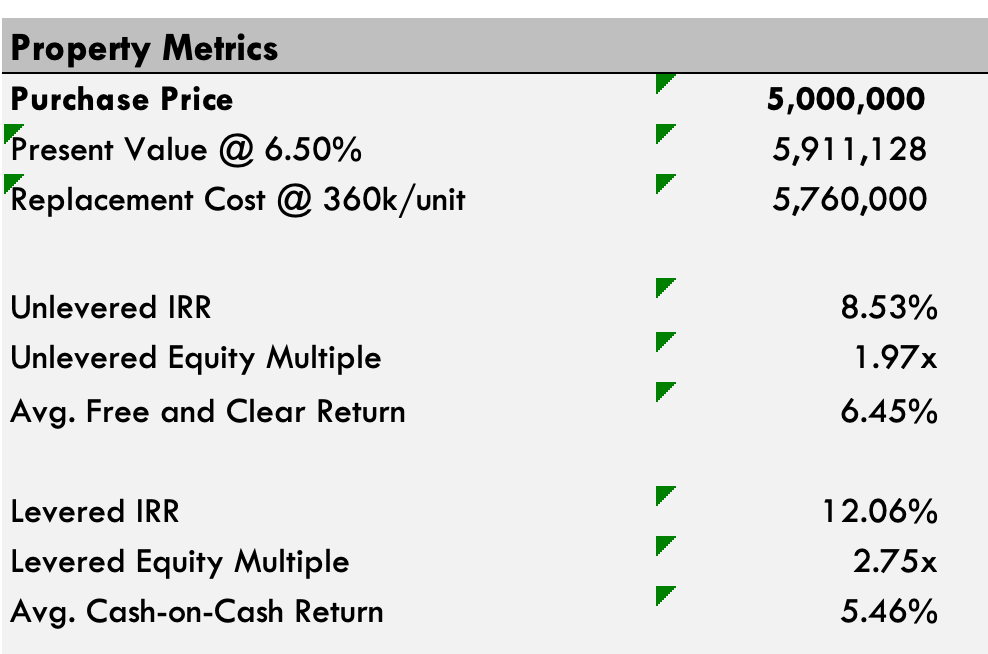

To wrap up this deal analysis, we will answer the three questions posed at the beginning of the article.

1. Based on the following transaction assumptions, the levered IRR would be 9.32% ( most investors like to see a double digit Irr), and the multiple would be 2.26x.

2. If the minimum IRR threshold is 9.32%, the equity required to buy this property is $2,015,750

3. To achieve a 12.0% IRR in order to attract investors; the sponsor would to acquire the property for $5,000,000 and raise the rent per $50

💰My 2cents: Deal or No Deal

Once you've identified the expected NOI and exit price based on comparables, you can determine the property's worth and establish your willingness to pay for the lots. With these calculations in hand, it should be easier to avoid overpaying. By submitting an offer around the $5m purchase price, you might attract investors and generate a 2x multiple on the equity over the next 10 years.

Analyzing a real estate deal requires precise calculations. While these calculations are only estimates, they give you the information you need to make a confident investment decision that’s backed up by data. Remember, local market conditions can vary, so you’ll have to consider that as well.

See you next Time and Happy Hunting!

Disclaimer

Cashflow Hub is a Bluelofts's newsletter that breakdown real estate and middle market opportunities with cash flow potential that hit the market. Subscribe for free and become a savvier investor. Cashflowhub or its affiliates present this post solely for informational purposes. The information provided herein is not verified or confirmed by Cashflowhub. Moreover, Cashflowhub does not make any offers to readers to participate in any transaction or opportunity described in this post. This post is not intended to recommend any investment and should not be considered as an offer to sell or a solicitation of an offer to purchase an interest in any current or future investment vehicle managed or sponsored by Bluelofts Inc or its affiliates (collectively referred to as "Bluelofts"; each investment vehicle referred to as a "Fund"). Any solicitation to purchase an interest will only be made through a definitive private placement memorandum or other offering document.