109 Residential lots in Lancaster Tx for build to rent! 💰

Location: Lancaster Tx

- Asking Price: $8,000,000

- Highest and Best Use: 109 Build for rent homes

😃 What are Build to rent homes?

BTR developments are new residential communities that address the nation's housing shortage and increase the U.S. housing supply. These communities offer single-family home characteristics and cater to renters seeking features not commonly found in multifamily properties.

Typically consisting of 50 or more homes or townhomes, BTR properties operate similarly to multifamily assets. A key aspect of BTR is that residents don't have anyone living above or below them. Owned by investors and professionally managed, these properties often provide community amenities and have an on-site leasing office.

🏠There are many benefits associated with investing BTR communities, which include:

· Better cash flow — Apartments can generate monthly income in the form of rents, which must be collected by yourself or a third-party property manager.

· Tax benefits — Like all real estate, BTR investments come with ample tax advantages, which means that owning an apartment will reduce your taxable income.

· Ability to increase appreciation — The property value relies on your ability to boost the net operating income.

· Economy of scale — Owning a BTR community instead of multiple single-family homes make it easier to obtain rent payments. Payments come from an individual location.

🧠 Property development glossary:

Before delving into the exact calculations on how to analyze this deal, let’s discuss the basic terms of a real estate development project:

· Hard cost: Hard costs are any type of spending that directly relates to the physical construction of a project. These costs include anything from landscaping, structural changes or anything else you do on a site

· Soft Cost: Soft Cost is a construction industry term but more specifically a contractor accounting term for an expense item that is not considered direct construction cost. Soft costs include architectural, engineering, financing, and legal fees, and other pre- and post-construction expenses.

· Developer Fee: The real estate developer charges a fee for their services, typically as a percentage of the development cost. This fee is referred to as a developer fee, and And your developer fee can be 3% of either the hard cost or the total project cost depending on what you can negotiate, and 1% of the total project cost

· GMP: A guaranteed maximum price (GMP) contract sets a maximum price for a construction project, beyond which the contractor absorbs additional costs. Sometimes called a construction manager at risk contract, this type of construction agreement minimizes financial risk for the owner because it sets a project cost limit.

· Total Rental Income is the total amount received from only rental income before taking into account any costs, expenses, taxes, etc. Rental income is any payment the property owner receives for the use or occupation of property.

· Operating expenses include all of the costs associated with operating the property. These include property management fees, insurance, utilities, property taxes, repairs, and maintenance.

. Equity: Equity financing refers to the process of raising capital by selling ownership stakes in a company or project

. Construction loan: A construction loan is usually a short-term loan that provides funds to cover the cost of building or rehabilitating of a project.

· Cap rate: These rates represent the expected rate of return that the property will have based on its income. When cap rates reduce, the value of the property increases. If you own a property and cap rates are dropping, this is great for the value of your investment. A calculation to refer to is: NOI / Value = Cap Rate

· If your property has a net operating income of $60,000 and is listed at $600,000, the cap rate could be set at 10.

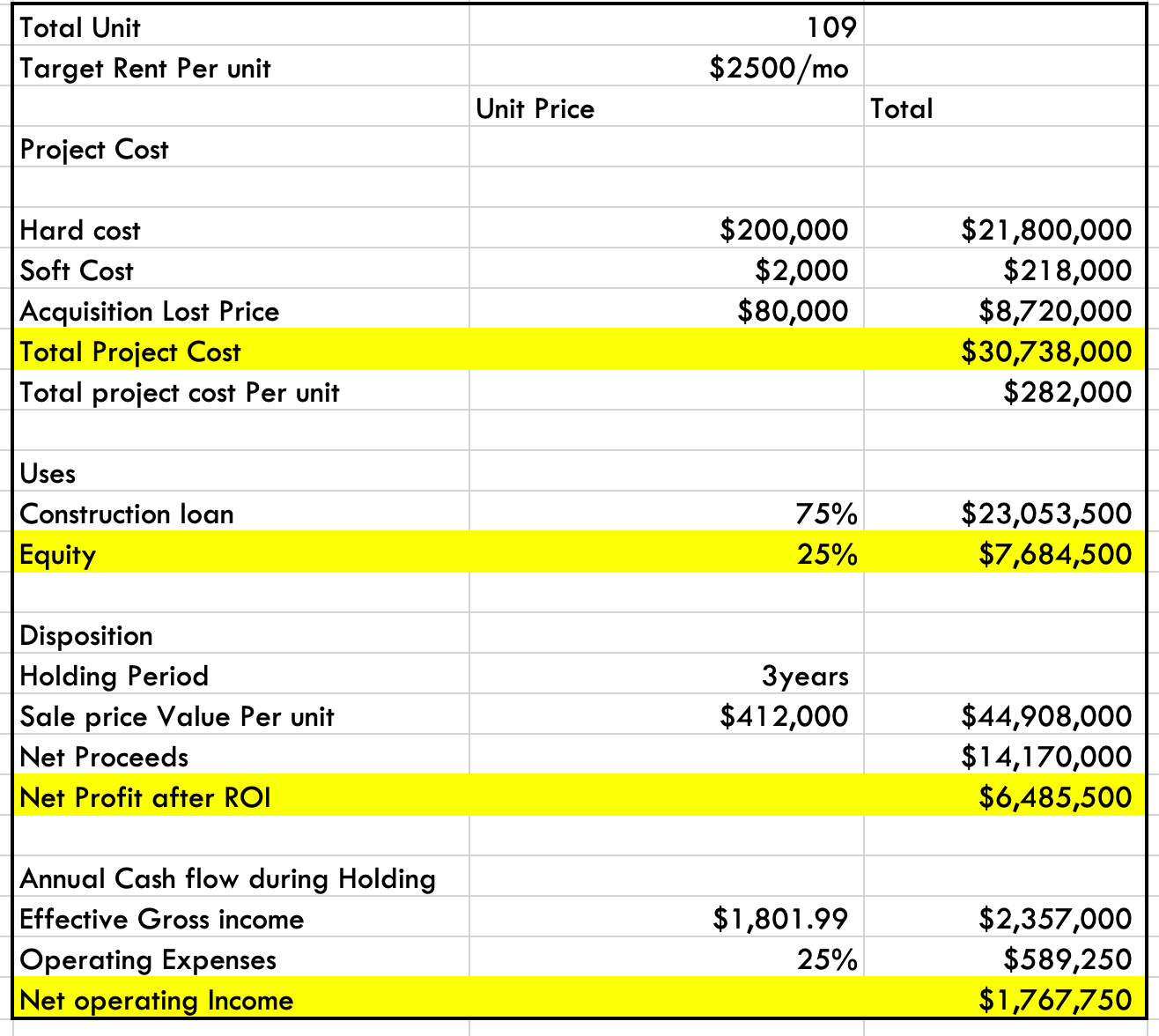

🤑 How to Identify Cost and Cash Flow to Determine profitability of this project?

💰My 2cents:

Once you’ve identified the expected NOI and Exit price based on comparable, you can determine what the property is worth and what you’re willing to pay for the lots. With these calculations in hand, it should be easier to avoid overpaying. A property’s purchase price equals the NOI divided by the cap rate.But on this deal, look very promising as the net proceeds after return on investment is $6,485,000 not including the net income that the property should generate during the holding period.

Analyzing an development deal requires precise calculations. While these calculations are only estimates, they give you the information you need to make a confident investment decision that’s backed up by data. Remember, local market conditions can vary, so you’ll have to consider that as well

See you next Time and Happy Hunting!

Disclaimer

Cashflow Hub is a Bluelofts's newsletter that breakdown real estate and middle market opportunities with cash flow potential that hit the market. Subscribe for free and become a savvier investor. Cashflowhub or its affiliates present this post solely for informational purposes. The information provided herein is not verified or confirmed by Cashflowhub. Moreover, Cashflowhub does not make any offers to readers to participate in any transaction or opportunity described in this post. This post is not intended to recommend any investment and should not be considered as an offer to sell or a solicitation of an offer to purchase an interest in any current or future investment vehicle managed or sponsored by Bluelofts Inc or its affiliates (collectively referred to as "Bluelofts"; each investment vehicle referred to as a "Fund"). Any solicitation to purchase an interest will only be made through a definitive private placement memorandum or other offering document.